The Importance of Cost and Price for MicroBusiness

In the intricate web of commerce, micro-businesses stand as the foundation of economies worldwide. While their scale might be modest, their significance is anything but. One of the fundamental pillars that upholds the growth and sustainability of micro businesses is determining costs and establishing competitive pricing.

In this blog, we delve into the importance of these aspects and explore how they contribute to the success of micro-businesses.

UNDERSTANDING MICRO-BUSINESSES

Micro-businesses are enterprises with fewer than five employees. From the corner coffee shop to the freelance designer working from home, these businesses play a critical role in fostering innovation, providing employment opportunities, and diversifying markets. Despite their small size, they hold immense potential for growth and prosperity.

DETERMINING COSTS -

For micro businesses, the journey to sustainable success begins with a firm grasp of the cost of delivering the goods. Determining costs to produce a product or offer a service involves identifying all direct expenses associated with the process. Pricing is a vital aspect of your business, as it directly impacts profitability and customer perceptions. To ensure your business thrives and your prices are seen as fair, it's crucial to calculate costs accurately. Understanding how accounting factors into pricing is key, as it influences your financial statements and tax reports.

Here's what you need to know about determining costs:

DIRECT EXPENSES (COGS) – These expenses determine the total cost.

Raw Materials (Ingredients) and Supplies: account for the costs of materials, ingredients, and supplies used to package or deliver to the customer.

Direct Labor Costs: Calculate wages, benefits, and other labor-related expenses for the sole proprietor or the employees who directly produce your products or provide services. However, it's important to note that labor costs are typically "allocated" across all the products produced.

This is where many entrepreneurs stumble. While supplies and labor contribute to product creation, the accounting practice involves allocating these costs across all products produced within a certain period, often monthly.

For example:

Let's say your direct supplies cost $2.00 and direct labor costs $120.00 per day. Combining these, you have $122.00 to allocate across all products made that day. If you made 10 bundt cakes, each cake's allocated cost would be $12.22.

Next, add this allocated cost to the cost of the ingredients per bundt cake, say $4.25. Therefore, the total cost per bundt cake would be $16.47.

The exception to this allocation method occurs when you're working on a specific project or order. For instance, if you're fulfilling a dessert table order for 150 people, all associated costs, such as hiring additional staff or renting equipment, are directly attributed to that order. It's important to differentiate between these direct costs and overhead expenses.

INDIRECT & OVERHEAD EXPENSES – These expenses come from the profits made from sales.

In-Direct Labor Costs: While they may contribute to the cooking or baking of products, if it CAN NOT be contributed directly to an order or poect then, this cost can be “allocated” across all the finished goods. While these might be smaller in scale for micro businesses, they are no less significant. for example, if this baking assistant's role is to create chocolate chards and a daily batch of Buttercream frosting, while these are used on customer orders, the labor per order is undeterminable. Therefore, the labor cost for the baking assistant is allocated.

Overhead Expenses: Overhead includes any other business activities or expenses not directly related to fulfilling orders, such as cleaning the kitchen at the end of the day. Also included are expenses like rent, utilities, insurance, and equipment maintenance. These costs are necessary to be open for business whether you make a sale or not.

Wages & Salaries: All employees of the business are that are not included in “direct labor”.

Marketing and Advertising: These expenses are vital for reaching customers and promoting products.

Why is this significant?

This holds significant importance for several reasons. Incorrectly factoring in costs directly impacts your profit margins, potentially diminishing your earnings. Reduced profits or losses can result in lower tax obligations or even exemption from taxes. Every industry establishes profitability benchmarks and cost guidelines, and inaccuracies in calculations can trigger audits. Audits may lead to decisions that you'd prefer to avoid, such as allegations of "falsified" tax returns. Moreover, these errors not only affect your bottom line but also tarnish the appearance of your financial statements. Realize these numbers are the core of your business. This could hinder your ability to secure business loans or attract investors, as it may appear that your business isn't generating sufficient profits. Therefore, it's imperative to ensure accurate cost calculations for both business and legal purposes.

ESTABLISHING COMPETITIVE PRICING -

Once the cost structure is understood, move on to setting competitive pricing. You might have noticed that the pricing of other baking businesses doesn't necessarily dictate what you should charge. While it's helpful to consider market trends and competitor prices, it's essential to recognize that your costs may vary significantly from theirs. Your primary aim should be to accurately determine the cost of producing your products within your own business. Focusing solely on competitors' pricing can be counterproductive, especially if you're consistently losing money with each sale.

Establishing competitive pricing requires finesse and insight into the market dynamics. Here are some key points to consider include:

Market Research: It is crucial to understand the pricing strategies of competitors and the perceived value of your products or services in the market. Your pricing should reflect your (UVP) unique value proposition.

Value-Based Pricing: Your pricing should align with the value your offerings provide to customers. If your product solves a specific problem or meets a need more effectively than alternatives, customers are often willing to pay a premium.

Covering Costs and Making Profits: When determining your pricing you should not only cover costs but also allow for a reasonable profit margin. After all, overhead expenses, marketing, and investments are paid from the profits you make. Failing to account for profits can lead to financial instability.

Flexibility: Micro-businesses have the advantage of agility. They can adjust pricing strategies more rapidly in response to market changes, giving them a competitive edge.

Building Customer Relationships: Competitive pricing doesn't mean constantly undercutting competitors. Building trust and relationships with customers can allow you to justify slightly higher prices based on the added value you offer.

BENEFITS BEYOND THE BOTTOM LINE -

Determining costs and establishing competitive pricing goes beyond financially surviving the day. In fact, it has far-reaching implications to prove that what you did yesterday will protect you tomorrow. For example:

Sustainability: Accurate pricing ensures that the business can cover costs and sustain operations, avoiding financial pitfalls.

Growth and Innovation: Profits generated from competitive pricing can be reinvested into the business for expansion, innovation, and improvement of offerings.

Reputation: Fair and transparent pricing builds trust and a positive reputation among customers, leading to repeat business and referrals.

Contribution to the Economy: As micro-businesses thrive, they contribute to job creation and local economic development.

In the intricate dance of commerce, micro-businesses wield a significant influence. By mastering the delicate balance between determining costs and establishing competitive pricing, micro-businesses can secure their foothold in the market and pave the way for enduring success.

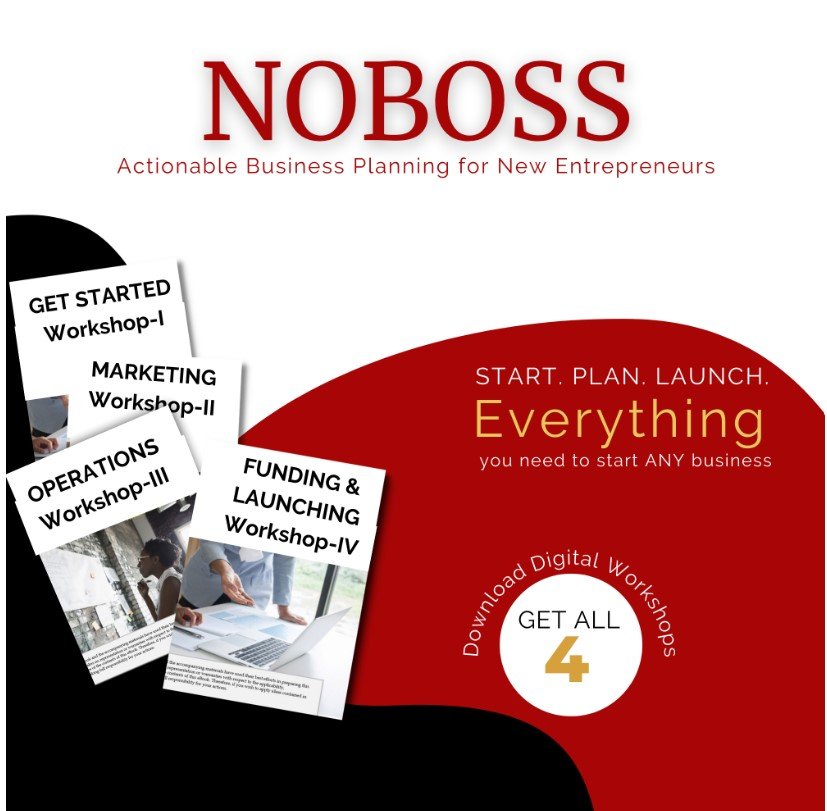

Join us for onDemand Workshop